I want to fix my house but have no money—if this is your situation, you’re not alone. This guide is for low-income homeowners and renters seeking affordable solutions to repair and maintain their homes. Safe, stable housing is essential for health and well-being, but many struggle to afford necessary repairs. Many families face the challenge of needing repairs but lack the funds to cover them. Fortunately, there are practical steps, resources, and programs designed to help low-income individuals and households access affordable housing repairs and improvements. This comprehensive guide outlines immediate actions, financial assistance options, community support, and long-term solutions to help you restore your home safely and affordably. The article places the needs of low-income homeowners at the center of the discussion.

- Introduction to Home Repair Challenges

- Understanding the Housing Market

- Immediate Steps for People Experiencing Homelessness and Domestic Violence

- Grant and Assistance Programs for Urgent Repairs

- Low Income Grants, Vouchers, and Local Support

- Down Payment Assistance and Repair Loans

- Alternative Financing Options

- Affordable Housing and Long-Term Solutions During the Housing Crisis

- DIY Low-Cost Repairs and Prioritization

- Working With Community Organizations for Repair Assistance

- Domestic Violence Survivors: Safe Housing and Repair Assistance

- Legal, Landlord, and Tenant Remedies

- Budgeting, Prioritizing, and Creating a Repair Plan

- Additional Tips and Considerations

- Next Steps: Applying, Follow-Up, and Tracking

Introduction to Home Repair Challenges

Home repair challenges can feel overwhelming, especially for low-income individuals and families already struggling with the effects of the housing crisis. With affordable housing in short supply, many households are forced to live in properties that need urgent repairs but lack the resources to address them. Rising energy costs add another layer of difficulty, making it even harder for low-income households to keep their homes safe, comfortable, and energy efficient. Programs like the Housing Choice Voucher Program, managed by the U.S. Department of Housing and Urban Development (HUD), are designed to help low-income families access affordable housing, but the process can be complex and eligibility requirements must be met. When considering repairs or renovations, it’s important to look for assistance programs and resources that can help reduce costs and improve your home’s energy efficiency, ultimately lowering monthly bills and making your home more affordable in the long run.

Next, let’s look at how the current housing market impacts repair options for low-income homeowners.

Understanding the Housing Market

Navigating the housing market can be challenging, especially during a housing crisis that has made affordable housing increasingly scarce. Low-income individuals, families, and homeless veterans often face significant barriers to finding stable housing. The Department of Human Services and other organizations are working to address these issues by providing resources, assistance, and support services to those in need. For homebuyers and homeowners, understanding the available options is crucial—whether it’s accessing loans for repairs, seeking affordable housing programs, or connecting with local services. By staying informed about the latest resources and support, families and individuals can better position themselves to secure safe, affordable housing and make necessary repairs to their homes.

Now that you understand the broader housing landscape, let’s explore immediate steps for those facing urgent housing needs.

Immediate Steps for People Experiencing Homelessness and Domestic Violence

For individuals experiencing homelessness or domestic violence, urgent housing repairs or relocations may be necessary to ensure safety and stability.

- Document Urgent Damage: Take photos and note timestamps of any damage or unsafe conditions in your home. This documentation is especially important for those experiencing domestic violence, as it can support applications for emergency assistance or legal remedies.

- Contact Local Shelters or Hotlines: Reach out immediately to domestic violence hotlines or local shelters. Local shelters assess health and risk factors to determine eligibility for shelter beds or waitlists. They can provide safe temporary housing and connect you to emergency resources.

- Eligibility for Shelter: Eligibility for shelter is determined through an official assessment of your health, vulnerability, and risk. This process helps ensure that those most in need receive appropriate support and placement, whether in a shelter bed or on a waitlist.

- Apply for Emergency Rental or Utility Assistance: Many communities offer funds to help with rent or utility payments to prevent homelessness or unsafe living conditions.

- Secure Temporary Safe Housing: If your home repairs are critical to safety, seek temporary housing options while repairs are underway.

If you are in immediate need, the next section covers specific grant and assistance programs for urgent repairs.

Grant and Assistance Programs for Urgent Repairs

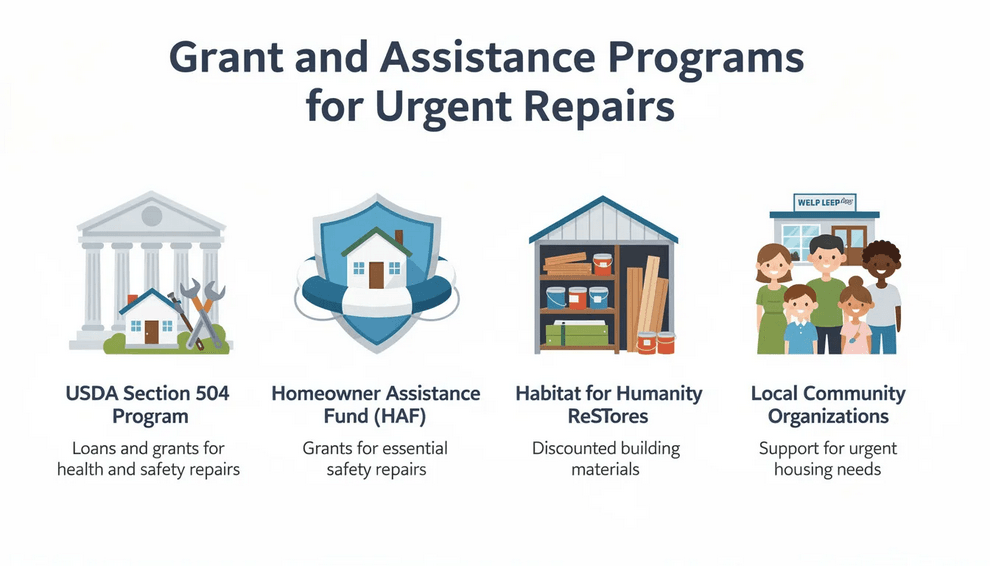

If you have no money for repairs, several programs and organizations can help:

- USDA Section 504 Program: The USDA Section 504 Program offers loans and grants to help low-income homeowners fix health and safety hazards in their homes.

- Homeowner Assistance Fund (HAF): The Homeowner Assistance Fund (HAF) offers grants for essential safety repairs to eligible homeowners facing financial hardship.

- Habitat for Humanity ReStores: Organizations like Habitat for Humanity ReStores provide donated building materials at reduced prices, making repairs more affordable.

- Local Community Organizations: Local community organizations can provide assistance for urgent housing needs and connect individuals to local resources and services.

These resources can be a lifeline for those who need immediate help to make their homes safe and livable.

Low Income Grants, Vouchers, and Local Support

There are several programs and community resources available to help low-income homeowners with repair costs or housing stability.

Weatherization Assistance

- Weatherization Assistance Programs: These programs provide free or low-cost energy efficiency improvements that reduce utility bills and improve home safety.

Community Development Block Grants

- Community Development Block Grants (CDBG): Local governments often distribute CDBG funds to support home repairs for eligible low-income households.

Public Housing Agency Programs

- Call 2-1-1: This free hotline connects you to a wide range of human services, including housing repair assistance and emergency support.

- Public Housing Agency (PHA) Voucher Programs: Contact your local PHA about eligibility for the Housing Choice Voucher Program, which can help with rent or housing options.

By exploring these options, you can find support to address urgent repair needs and maintain housing stability.

Next, let’s review financing options for those looking to buy or improve a home.

Down Payment Assistance and Repair Loans

If you are looking to buy and repair a home or improve your current property, several loan programs and assistance options may help.

- Down Payment Assistance Programs: These programs help eligible homebuyers cover down payments, making homeownership more accessible.

- Rehabilitation Loans: Fixer-upper loans allow buyers to finance both the purchase price and renovation costs with a single loan. Common options include:

- FHA 203(k) Loan: Allows you to finance home purchase and repairs with as little as 3.5% down.

- Fannie Mae HomeStyle Loan: Offers flexible renovation financing for primary residences.

- USDA Renovation Loan: The USDA Section 504 Program offers loans and grants to help low-income homeowners fix health and safety hazards, especially in rural areas.

- Homeowner Assistance Fund (HAF): The Homeowner Assistance Fund (HAF) offers grants for essential safety repairs.

- Home Equity Loans and Cash-Out Refinancing: These can provide additional funds for home improvements after purchase.

- Personal Loans: May be an option for some homeowners, but review terms carefully to ensure affordability.

Tips for Applying:

- Gather income verification, identification, and property information to streamline loan or grant applications.

- A mortgage preapproval letter shows sellers and agents that you’re a serious buyer when looking for a fixer-upper.

- Many renovation loans for fixer-uppers require a special appraisal to estimate the home’s post-renovation value.

Understanding your financing options can help you make informed decisions about repairing or purchasing a home.

Alternative Financing Options

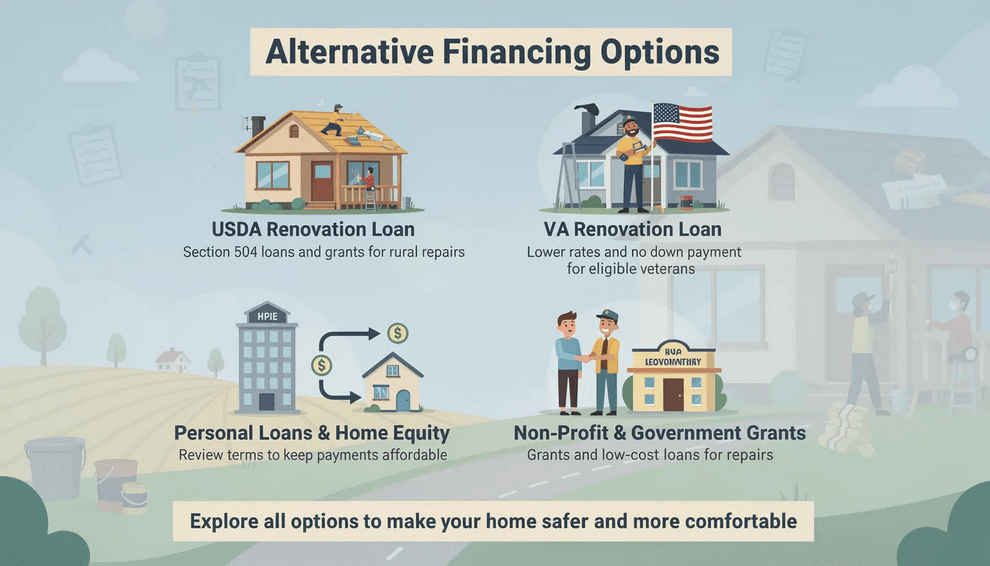

If you don’t qualify for traditional loans, there are alternative financing options that can help you repair or renovate your home.

- USDA Renovation Loan: The USDA Section 504 Program offers loans and grants to help low-income homeowners fix health and safety hazards, especially in rural areas.

- VA Renovation Loan: Eligible veterans can take advantage of the VA renovation loan program, which often features a lower interest rate and no down payment requirement.

- Personal Loans and Home Equity Loans: These are options for some homeowners, but it’s important to carefully review the terms to ensure the payments fit your budget.

- Non-Profit and Government Grants: Other resources such as non-profit organizations and government agencies may provide grants or low-cost loans to help with repairs and renovations.

Exploring all available assistance can help low-income households find the support they need to make their homes safer and more comfortable.

Now, let’s consider long-term solutions for affordable housing during the ongoing housing crisis.

Affordable Housing and Long-Term Solutions During the Housing Crisis

- Affordable Housing Waitlists: Apply promptly to local affordable housing programs and waitlists to secure a stable home.

- Attend Housing Authority Meetings: Engage with your local housing authority or city council to stay informed about new housing initiatives.

- Nonprofit Housing Programs: Some nonprofits convert vacant or underused buildings into affordable housing for low-income families and individuals.

By staying proactive, you can improve your chances of securing long-term, stable housing.

Next, let’s look at practical ways to manage repairs on a tight budget.

DIY Low-Cost Repairs and Prioritization

- Prioritize Safety Repairs: Focus first on repairs that address safety problems, such as electrical hazards or structural issues.

- Learn Simple Repairs: Utilize free tutorials for basic plumbing, electrical fixes, or weatherproofing to reduce costs.

- Salvage Materials: Organizations like Habitat for Humanity ReStores provide donated building materials at reduced prices.

- Skills Swap: Organize labor exchanges with neighbors or community members to assist with repairs.

Taking these steps can help you stretch your budget and address the most urgent repair needs.

Now, let’s explore how community organizations can support your repair efforts.

Working With Community Organizations for Repair Assistance

Community organizations can be a vital resource for urgent housing needs. They often provide direct assistance, connect individuals to local resources and services, and may receive funding from HUD to support housing stability.

- Habitat for Humanity: Reach out to local Habitat affiliates that offer repair volunteer programs and affordable home improvement solutions.

- Faith-Based Groups: Many churches and community organizations provide volunteers or small grants for home repairs.

- Case Management Services: Request case management to help navigate resources and maintain housing stability.

- Local Community Organizations: Local community organizations can provide assistance for urgent housing needs and connect you to local resources and services.

These organizations can help you access the support you need to keep your home safe and livable.

Next, let’s address the unique needs of domestic violence survivors seeking safe housing and repair assistance.

Domestic Violence Survivors: Safe Housing and Repair Assistance

- National Domestic Violence Hotline: Call for immediate support, including confidential access to repair or relocation funds.

- Advocate Support: Domestic violence advocates can guide you through housing protections and safety planning.

- Legal Advice: Obtain legal assistance to understand tenant rights and protections related to housing and repairs.

If you need legal or landlord support, the following section will help.

Legal, Landlord, and Tenant Remedies

- Review Tenant Rights: Nonprofit legal aid organizations can help you understand your rights and responsibilities.

- Habitability Complaints: File complaints with local housing authorities if your landlord fails to address necessary repairs.

- Written Repair Requests: Always send repair requests in writing and keep copies with dates for documentation.

Understanding your rights can help you advocate for necessary repairs and safe living conditions.

Now, let’s discuss how to plan and budget for repairs effectively.

Budgeting, Prioritizing, and Creating a Repair Plan

- Itemize Repairs: List repairs by urgency, cost, and timeline to plan effectively.

- Contractor Estimates: Obtain at least three estimates for major repairs to find the best deals and budget accurately.

- Phased Repairs: Schedule repairs in phases to match available funds and reduce financial strain.

Careful planning can help you manage repairs even with limited resources.

Additional Tips and Considerations

When considering the purchase of a fixer-upper or planning major home repairs, keep these key factors in mind:

- Assess the property’s condition, location, and renovation potential.

- Research the local housing market to understand your options.

- Review the eligibility requirements for different loan programs, as the loan approval process often requires detailed information about your income, credit, and assets.

- Work with a real estate agent who specializes in fixer-uppers to find the best deals and navigate the process more smoothly.

- Prioritize energy efficiency and safety in your renovation plans to save on long-term energy costs and improve your home’s value.

- Take advantage of resources like the Housing Choice Voucher Program and other government initiatives to support your housing needs and make the most of available assistance.

Next, let’s outline the steps to apply for assistance and keep your repair process on track.

Next Steps: Applying, Follow-Up, and Tracking

- Organize Documents: Keep all application materials in one folder for easy access.

- Track Deadlines: Use a calendar to note application deadlines and appointments.

- Follow Up Regularly: Maintain contact with agencies and caseworkers to stay informed about your applications and available services.

Key National Hotlines, Programs, and Local Contacts

- HUD (U.S. Department of Housing and Urban Development): Provides information on housing assistance programs and local resources.

- 2-1-1 Hotline: Connects callers with local human services, including housing repair assistance.

- National Domestic Violence Hotline: Offers confidential support and resources for survivors.

- Local ReStores and Habitat Affiliates: Provide materials and volunteer help for home repairs.

- Legal Aid Organizations: Assist with tenant rights and housing-related legal issues.

By following these practical steps and leveraging available resources, low-income homeowners and renters can find pathways to repair and maintain their homes, even when funds are tight. Remember, help is available, and taking the first step to reach out to local organizations or programs can make a significant difference in your housing stability and quality of life.